Stavolta non si tratta di semplici voci, come quelle che da ormai diversi anni vedono a turno l’interesse di diversi Big – da ABB a Schneider Electric – all’acquisizione del pacchetto azionario di Rockwell Automation. Il presidente e amministratore delegato di Emerson, David N. Farr, ha infatti inviato una lettera ufficiale al suo omologo in Rockwell Automation, Blake Moret, formalizzando un’offerta di acquisto e aumentando l’offerta rispetto a quella già presentata privatamente a fine ottobre e rifiutata dalla società americana.

Emerson propone di versare nelle casse degli azionisti della Casa di Milwaukee 225 dollari per azione (29 miliardi di dollari in tutto), costituiti da 135 dollari in contanti e 90 dollari in azioni Emerson, con un premio del 30% rispetto al valore di mercato medio delle azioni nel trimestre agosto-ottobre. In questo modo gli azionisti Rockwell diventerebbero proprietari del 22% della società risultante dall’acquisizione, che Emerson propone di chiamare Emerson Rockwell e che avrebbe un giro d’affari complessivo di ben 23 miliardi di dollari.

Nella lettera, che riportiamo integralmente in calce, Farr mette l’accento sulle sinergie tra le due aziende. Rockwell Automation, dal suo canto, ha detto che il suo Board of Directors “considererà con attenzione la proposta di Emerson”.

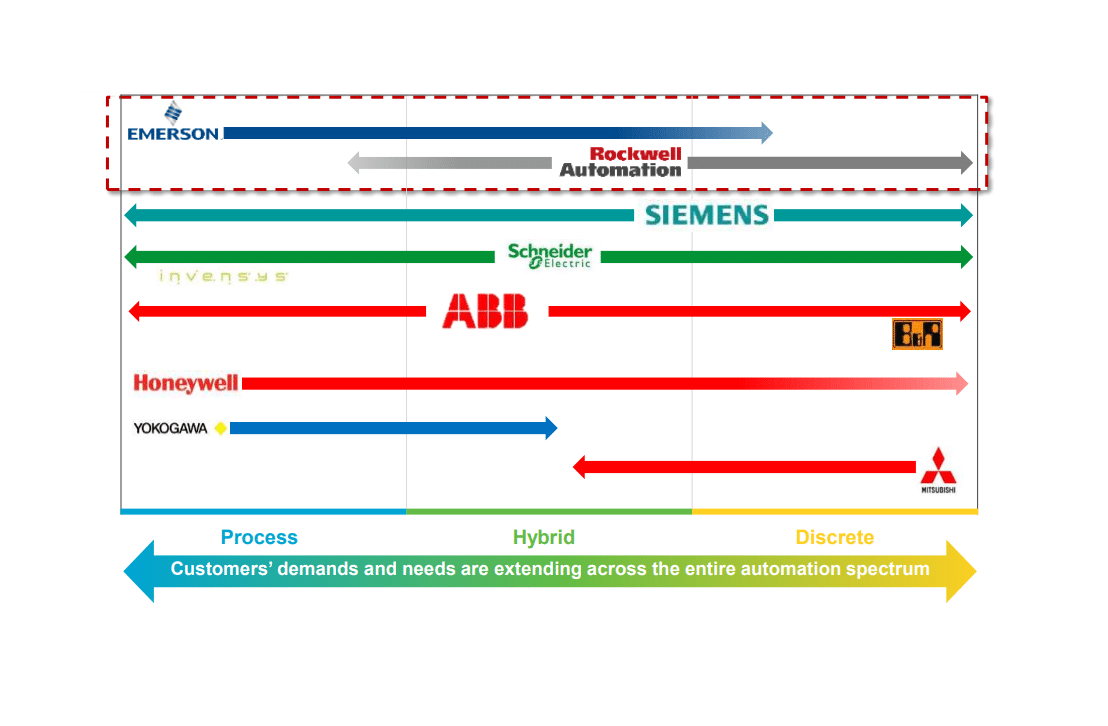

Ricordiamo che Emerson è uno dei maggiori player mondiali nell’automazione per l’industria di processo, mentre Rockwell è ben posizionata nell’automazione di fabbrica. Il nuovo soggetto potrebbe quindi rivaleggiare a tutto campo, oltre che con Siemens, anche con ABB (che si è rafforzata nell’automazione di fabbrica con l’acquisizione di B&R) e con Schneider Electric, che si è invece potenziata nel settore dell’automazione di processo con l’acquisizione di Invensys.

La lettera di Farr

Dear Mr. Moret:

Over the past several months, we have attempted to engage with you privately regarding a business combination of Emerson Electric and Rockwell Automation. We remain convinced there is compelling strategic, operational, and financial merit to bringing together our two companies – and that such a combination would benefit our respective customers, employees and shareholders.

The industrial logic for this combination is clear. A combination of Emerson and Rockwell would create a leader in the $200 billion global automation market. Together, we could offer an unmatched technology portfolio that addresses customers’ current and future needs for a fully connected enterprise, where process, discrete, and hybrid work seamlessly together rather than relying on single, disparate platforms. By leveraging the key technology platforms that are the strengths of Emerson and Rockwell, we can create an industry leader with unmatched capabilities that integrates all aspects of the automation system for a global customer base. Competitors are already moving to provide integrated solutions. The combination of Emerson and Rockwell would accelerate our combined growth and position us for success for many years to come.

Terms and Value Creation

Given our continued conviction in the significant value creation opportunity this combination represents, I am sending you an enhanced proposal for Emerson to acquire Rockwell in a transaction that would provide Rockwell shareholders with immediate and long-term value that we believe is well in excess of what Rockwell could achieve on a standalone basis.

Rockwell shareholders would receive $225 per share, consisting of $135 in cash and $90 in Emerson shares. This represents an attractive 30% premium to Rockwell’s undisturbed 90-day volume weighted average share price as of October 30, 2017, the day before our prior acquisition proposals became public.

The portion of the consideration to be paid in Emerson stock would result in Rockwell shareholders owning approximately 22% of the combined company, allowing them to participate in the significant value creation from synergies generated by a combination. Based on public information only, we estimate the total capitalized value of synergies to be in excess of $6 billion, which equates to over $1.3 billion or $10 per share of additional value to Rockwell shareholders through their continuing ownership. Including the value of synergies, Rockwell shareholders would receive $235 per share in total value, representing aggregate value creation of 36% compared to Rockwell’s undisturbed 90-day volume weighted average share price as of October 30.

Enhanced Profile and Strong Balance Sheet

The combined company would have increased scale across key end markets, with approximately $23 billion in annual revenue, supporting increased investments in software and technology and an acceleration of both top-line and bottom-line growth. We expect the transaction would be accretive to adjusted EPS and free cash flow in year one. Estimated synergies and enhanced operating efficiencies would result in an operating margin of approximately 20% as well as double-digit EPS growth. We will remain committed to maintaining an investment grade credit rating and expect the combined company to generate free cash flow of more than $3 billion in year one, enabling additional strategic investment, rapid deleveraging and return of capital to shareholders through dividends and share repurchases.

Commitment to Engage on Social Issues

As outlined in our proposals, we would work with Rockwell to select a management team using a “best of both” philosophy, with significant roles for members of your existing team. This would provide the combined company with the greatest opportunity to succeed by enabling us to choose the right people for the right roles from both of our world-class organizations. We would expand our current Board from 10 to 13 directors, with three directors nominated from the current Rockwell Board. We would work with you to provide appropriate commitments to Rockwell employees and communities to ensure the combination is mutually beneficial to all of our stakeholders.

As noted in our previous offers, we propose to name the combined company “Emerson Rockwell” to reflect the legacies of our two companies. We would also maintain a significant presence in Milwaukee as an “automation center of excellence” for the combined company. We look forward to engaging with you to identify additional ways to capture the absolute best of both organizations.

Regulatory Approvals and Financing

We and our advisors have conducted extensive analysis of the regulatory approvals that would be required in connection with the proposed transaction, and we are confident that the transaction would receive all necessary approvals in a timely manner. We do not anticipate any material antitrust or other regulatory issues that would extend the normal timetable for closing a transaction of this nature. We strongly believe the combined company would be able to do more for our customers than either of us could do separately. We are confident that our common global customers will embrace the proposed transaction and, in fact, we have already received positive feedback from many of them about the potential market benefits that would result from a combination.

Our proposal is not subject to any financing contingency. We have had in-depth discussions with J.P. Morgan, which is highly confident Emerson can finance the cash portion of the transaction with a combination of cash on our balance sheet and newly issued debt.

Next Steps

We sincerely hope you and your Board will objectively evaluate the strategic, financial and operational benefits of this transaction and agree to meet with Emerson to negotiate a mutually beneficial transaction. We, along with our advisors, Centerview Partners, J.P. Morgan and Davis Polk, stand ready to commence private discussions with Rockwell and its advisors. I look forward to your prompt response and to sitting down with you to discuss this unique opportunity for both of our companies.

Sincerely,

David N. Farr

Chairman and Chief Executive Officer